Hey there! Coinvise is a web3 platform that helps creators & communities build and manage their Social Tokens. You can join the community here. If you find this essay interesting, make sure to subscribe to this newsletter and follow Coinvise on Twitter. Enjoy! 🔥

Social tokens are digital currencies that have shown their efficiency in building successful digital economies. They can revolutionize the way people collaborate and allow a whole new world of possibilities for workers. Good incentives through Social Tokens are ideal when it's mutually beneficial to contributors and community leaders. It will create positive-sum games where everyone has an aligned interest.

However, with Social Tokens comes the risk of speculation. Speculation is not necessarily a bad thing. It drives interest from people outside of crypto and brings capital to a community that can innovate and grow. It is, however, very complicated to build a healthy and sustainable community in the long-term with a highly volatile token and community members here to speculate. At some point, for a community to grow, it's essential to have people that put time and hard work into the community, not capital.

To prevent speculation, community leaders can lock N amount of Token for a certain period as a commitment to hold the Token. It prevents people from coming with the only purpose of buying and selling the Token a few days later when it pumps. This mechanism is called Vesting Schedule. This essay aims to explain further what a Vesting Schedule is and how it can be a powerful tool to build a sustainable decentralized community.

1 - What is Token Vesting?

When launching a decentralized community (or a DAO), it's common to establish a Token for governance purposes and for attracting / rewarding high-quality talent. The Token is usually minted (created) by the community's founding members, and those community leaders have full power over the distribution of the Token.

This is much power centralized in the hands of very few people. If contributors start to put time into the project and investors start to bring capital to the project, it's important to cover them and not let core team members have full freedom over the token distribution. To prevent bad behaviors, it's recommended to vest a portion of those tokens to ensure the long time commitment of the founding team.

Concretely, vesting a token means locking a certain amount of tokens over a certain period as a commitment to hold the Token. It's a mechanism that allows the founding team to prove they are highly interested in the project.

Locking tokens ensures investors that the team has the best intention and maintains a long-term vision, incentivizing them to continue working on the project development. When a token is vested, the owner of those Token can't withdraw them directly and have to wait until the vesting period ends. It's made possible thanks to blockchain mechanisms, and specifically smart contracts, that make it easy to lock a certain amount of funds until contract conditions are met. In our case, when the vesting period has been completed, the smart contract, enforced on a blockchain, will allow the holders to withdraw their tokens.

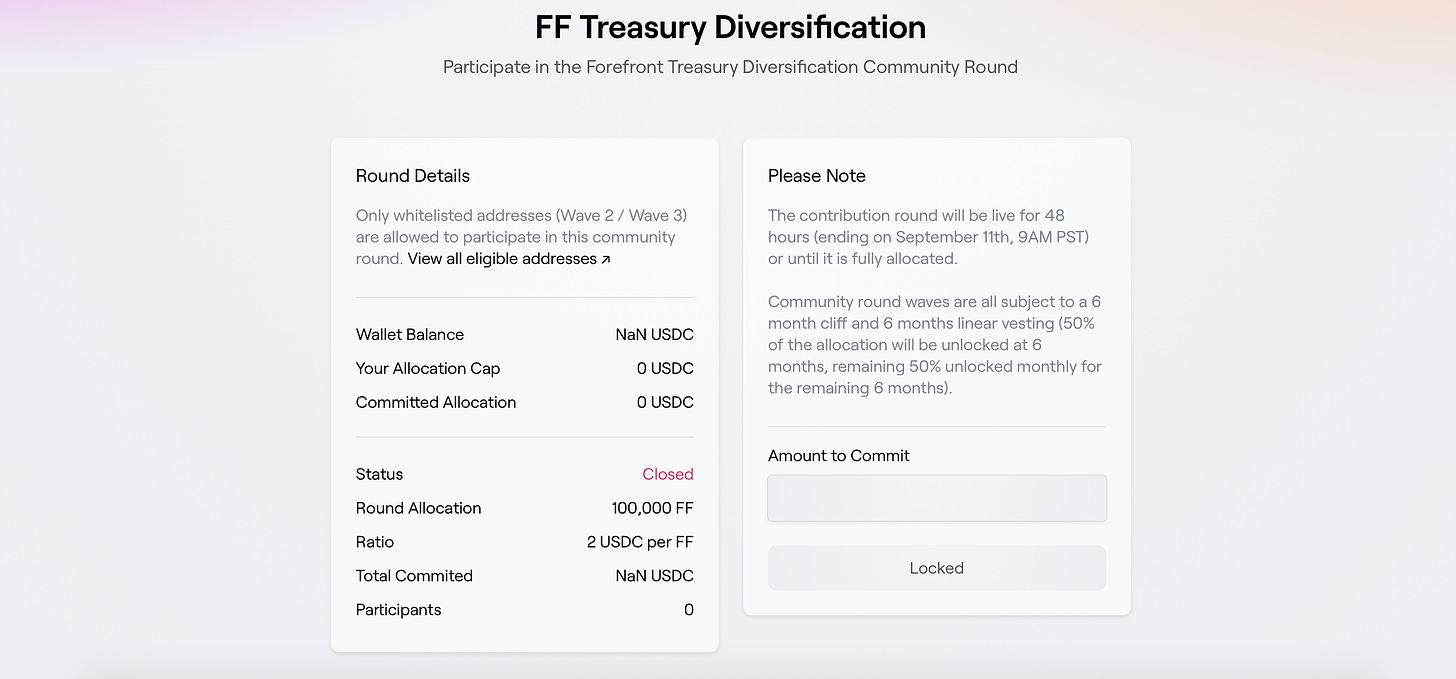

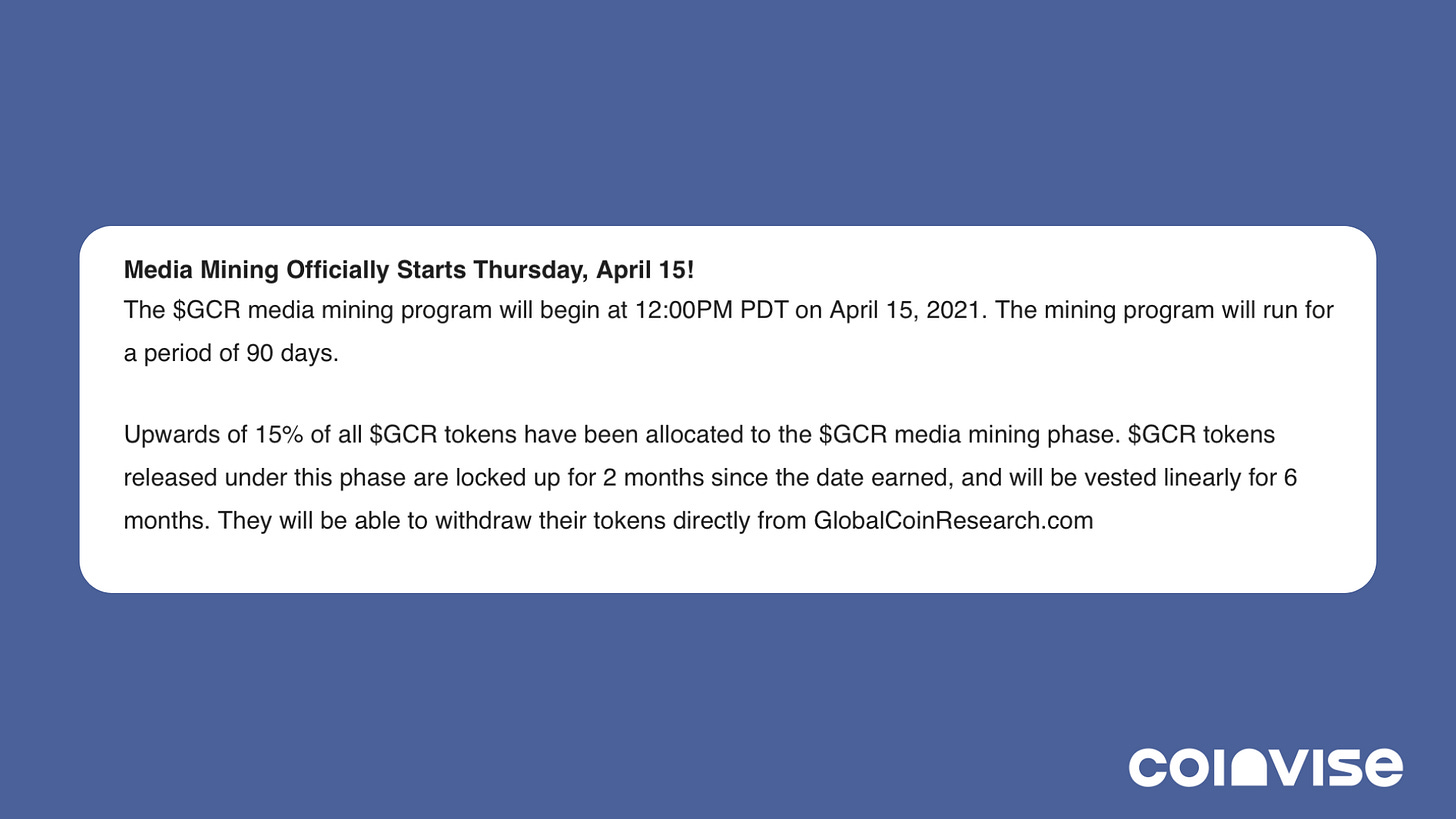

Depending on the needs, it's possible to play on many parameters when vesting a Token. It's possible to play with the vesting period, the number of tokens subject to vesting, if the tokens will be released gradually etc... It's important to keep in mind that there is no right or wrong answer. A project could reserve 15% of its coins when the Token is minted, then gradually released some tokens every month/quarter/year during the project process. Another project could create a Community Round subject to vesting, with a vesting period that includes a 6-month cliff, followed by another six-month linear unlock. In this case, community members would receive a certain amount of Token, let's say 1200, but wouldn't be able to withdraw them for six months. They would then receive 200 tokens every month for six months.

Keeping a certain amount of Token on a vesting schedule is a powerful tool to incentivize people to invest in a community. Crypto mechanisms made it easy for community members, investors, and founders to trust each other. With smart contracts, vesting a token is easy and is a tool worth using for every community.

Let's dig more into the main advantages of the Vesting Schedule.

2 - What is it useful for?

To create a healthy and sustainable community, it is essential to have token price stability. Indeed, with a highly volatile token, it will be difficult to attract talent keen to work in exchange for a Token that can plummet overnight. Vesting a Token allows reducing the price volatility of a token by disincentivizing speculation. Indeed, suppose speculators know they won't be able to withdraw their money as soon as they want. In that case, eventually, they won't invest. Only true believers of the project will stay around.

Vesting a token ensures the investors that the founding team is serious encourages contributors to commit in the long-term and prevents speculation.

The vesting schedule mechanism is particularly useful:

- For treasury diversification - when allowing community members to claim a token in exchange for some other tokens such as Ethereum, it can be useful to vest the tokens to ensure the long-term commitment of the new investors. It will limit the volatility of the Token for a certain period. It creates a fair process that rewards purchasers who support the project at launch and do so throughout the project's lifecycle by holding or utilizing the Token.

- For crowdfunding - Instead of receiving a total share of their tokens after the crowdfunding, the team members receive tokens after regularly scheduled vesting periods determined by the project founders. This way, alone unscrupulous team members can't run off with tokens without contributing to the project.

Let's also dig more into the main advantages of vesting a token.

- Vesting shows that the team is highly interested in the project - Locking tokens ensure investors that the team has the best intention and maintain a long-term vision for the project, incentivize them to continue working on the project development.

- Vesting lowers market price manipulations - There is often a several-year "cliff," meaning that the individual must be with the company for a couple of years to release the first increment of tokens.

- Vesting limits the risk that few entities control a large proportion of the project's tokens - It prevents the small group of people present when the supply has been minted to create supply fluctuations that can be ultimately damaging to the Token's ecosystem and price.

- Vesting helps keep the power centralized until the community is strong enough to be decentralized - When rewarding a community through Tokens, it's better if the core team managed the token supply and transactions and kept the voting power centralized. By doing so, they'll have a firmer grasp of the token prices and will be able to build a strong and sustainable community.

It's also good to keep in mind that the more the already distributed tokens are used, the more valuable the reserved ones become, so it's in each project team member's best interest to create a successful project that has many users, increasing the value of their tokens in the process.

Conclusion

All those elements make vesting an integral part of Tokenomics. We call Tokenomics all the things that enable participants to earn more tokens by contributing positively. Setting up Tokenomics for a project means "What can be put in place to incentivize a community to participate in the project." It's a tool worth using for every community leader, and vesting is likely to be a key component of most crypto launches for the foreseeable future. The protection that affords a token's value in an incredibly volatile market is invaluable.

Having a token over a vesting schedule is an efficient way to protect investors, founders, and collaborators. Indeed, as shown in this essay, locking a certain amount of Token allows to disincentivize founders and early investors to sell all their tokens with early traction. It also disincentivizes contributors to come only for speculation purposes.

Want more?

Follow us on Twitter, Instagram and join us on Discord 🔥

Thanks for being here!